Federal Student Aid

Post University admits students on a rolling basis, therefore there is no strict financial aid deadline. However, online students are encouraged to submit all financial aid documentation at least one week prior to the start of a module to ensure the financial aid can be disbursed promptly.

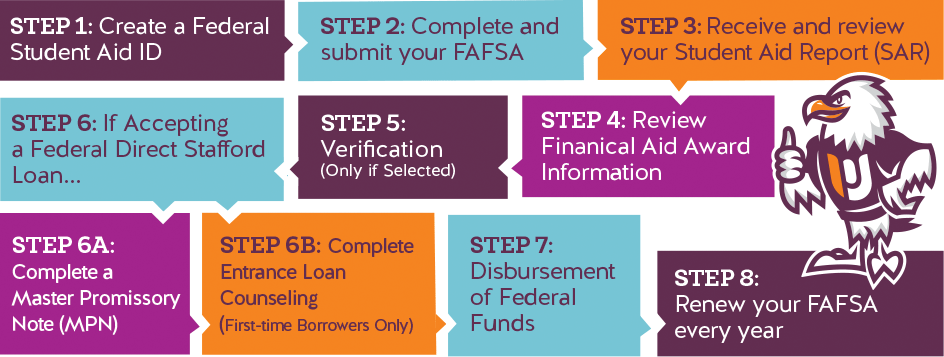

To start the financial aid process, follow these simple steps:

Applying for Federal Student Aid

Get the details of each step below. Questions please visit the FAQs page or contact your Financial Aid Advisor via the Student Portal.

Step 1: Create a Federal Student Aid ID

Students, and parents, if applicable, must create an FSA ID to complete and electronically sign the FAFSA. The FSA ID confirms identity when financial aid information is accessed electronically. If students or parents don’t already have an FSA ID, one can be created by visiting https://studentaid.gov/help/fsa-id. The authentication allows access not only to the FAFSA on the web, but also to other student aid websites.

Step 2: Complete and submit the FAFSA by visiting https://fafsa.gov.

The Free Application for Federal Student Aid (FAFSA) is the only application required to apply for federal student aid. This application allows Financial Aid to determine a student’s eligibility for federal, state and institutional aid. The FAFSA must be completed every year.

Post’s school code is 001401 and must be included on the FAFSA for Post University to receive a student’s information.

Please note, when completing the FAFSA, students and parents are encouraged to use the IRS Data Retrieval Tool (DRT) if the tax return has already been filed. This option is available during the completion of the FAFSA and is the most accurate way to submit income information. If a tax return has not been filed, the DRT process cannot be used. Students and parents will need untaxed income information to complete the FAFSA. Examples include prior year W-2 forms, 1099-SSA, etc.

Step 3: Receive and Review Student Aid Report (SAR)

Once the FAFSA is electronically submitted, students can expect to receive a Student Aid Report (SAR) within three to five days. Carefully review the Student Aid Report (SAR) and follow any instructions on the SAR for making corrections or updates.

If assistance with the SAR is needed, contact the Federal Student Aid Information Center at 800.4.FED.AID.

Step 4: Financial Aid Offer Information

Post University’s Office of Student Finance will determine financial aid award information for eligible students who successfully complete and submit a FAFSA. Students must view their award information on their student portal to accept each award. Additionally, students may reduce or decline any portion of their aid offer in the portal. The Financial Aid Advisor will review the aid offer with each student to help them understand their college financing options.

Post will not disburse any funding to students without a student’s active acceptance of each fund.

To log into the Student Portal to review your Award or access your Student Account, select the Student Login link at the top of Post.edu and enter your username and password.

As loans are an obligation that must be repaid, students are encouraged to borrow responsibly.

Step 5: Verification (if selected)

Step 6A: If accepting a Federal Loan, you must complete a Master Promissory Note (MPN)

Step 6B: If accepting a Federal Loan, complete the Entrance Loan Counseling (first-time borrower only)

Students who decide to accept a Federal Loan and are considered first-time borrowers must complete Entrance Loan Counseling electronically using the FSA ID, available at https://studentaid.gov/entrance-counseling/

Loan Counseling is required to help students understand their rights, responsibilities and obligations of borrowing from the federal loan programs. During loan counseling, students will receive information on loan interest rates, repayment periods and minimizing the risk of defaulting on a federal student loan.

Step 7: Disbursement of Federal Funds

The disbursement of federal funds to students’ accounts occurs upon the receipt and review of all necessary documents. The disbursement of funds typically occurs the second week of a semester or term after the end of the add/drop period and the active verification of participation in courses.

Disbursement of Federal Funds to the Online (Accelerated Degree Program) Only

Eligible students can expect to receive a disbursement of their financial aid funds every term in which they are enrolled and are eligible. For questions concerning the disbursement of financial aid funds, students should contact their Financial Aid Advisors. The University disburses aid each term that a student attends and no disbursement is made during periods of non-attendance.

Step 8: Renew the FAFSA every year attending.

Step 8: Renew the FAFSA every year attending.

Federal Aid Eligibility and Policies

Students must meet certain financial aid eligibility requirements to qualify for federal aid, including:

General Eligibility Requirements

To qualify for federal student aid, students must:

- Be enrolled as regular students in eligible programs.

- Have high school diplomas, GEDs or completed home schooling.

- Be U.S. citizens or eligible non-citizens.

- Make Satisfactory Academic Progress (SAP)

- Maintain half-time enrollment.*

- Not be in default on a federal loan or owe repayment on a federal grant.

*Half-time enrollment is not required for Federal Pell grants.

Types of Federal Financial Aid

Federal Financial Aid Grant Programs

Federal Pell Grants

A Federal Pell Grant, unlike a loan, does not have to be repaid. Eligibility for this grant is determined by students’ financial needs and meeting general eligibility requirements. Students cannot receive Federal Pell Grants at more than one institution concurrently. The amount of Federal Pell Grant funds students may receive over their lifetimes is limited to the equivalent of six full-time years of Pell Grant funding.

Federal Supplemental Educational Opportunity Grant (FSEOG) The Federal Supplemental Educational Opportunity Grant (FSEOG) is a need-based program for students with exceptional financial need. FSEOG funds are extremely limited and available only to undergraduate students who have not earned a bachelor’s or professional degree.

Federal Financial Aid Loan Programs

Federal Direct Student Loans

Federal Direct Loans are available for eligible students who are enrolled at least half-time. Half-time enrollment for undergraduate students is defined as of a minimum of 6 credit hours per payment period. Half-time enrollment for graduate students is defined as a minimum of 3 credit hours per payment period. The credits must count toward students’ Programs of Study. Students who complete the academic requirements for Programs of Study but do not yet have degrees or certificates are not eligible for additional FSA funds for those Programs of Study. Loan repayment begins after the grace period ends or when students drop below half-time enrollment.

Federal Direct Subsidized Student Loans

Federal Direct Subsidized Loans are available to undergraduate students who demonstrate financial need. The U.S. Department of Education subsidizes interest while students are enrolled at least half-time or during the grace periods, or deferment periods.

Federal Direct Unsubsidized Student Loan

Federal Direct Unsubsidized Loans are available to undergraduate and graduate students and are not based on financial need. Loan limits are higher for independent undergraduate students than for dependent students. Graduate students are only eligible to receive unsubsidized student loans. Students are responsible for interest charges over the course of the loan(s). Dependent students have lower unsubsidized annual loan limits than independent students. If a dependent student’s parent(s) cannot borrow Direct PLUS Loans; the students become eligible for additional unsubsidized annual loan amounts that apply to independent students.

Direct Parent Plus and Graduate Plus Loans

Direct PLUS Loans are loans for eligible graduate or professional students and eligible parents of dependent undergraduate students to help pay for the cost of the students’ educations. Graduate or professional students should exhaust unsubsidized loans before taking out Direct Graduate PLUS Loans.

Federal Student Loan Limits

Federal Direct Loans have both annual and aggregate limits. Annual loan limits apply to the academic year whereas aggregate limits apply to the students’ entire borrowing histories. Annual loan limits may be increased as students progress to higher grade levels. Loans are subject to proration for undergraduate students whose remaining length of the Program of Study is less than one academic year. Additional information on loan limits can be found at https://studentloans.gov.

Federal Work Study (FWS) Program

The Federal Work-Study (FWS) Program provides jobs for undergraduate and graduate students who demonstrate financial need. FWS gives the student a chance to earn money to help pay for educational or personal expenses while working on campus or in community service work.

A FWS student is paid through a combination of institutional and federal funds. FWS Students are eligible to receive an award each academic year. Any amount unused within an awarded term will be voided at the conclusion of the academic year. Once the FWS award is earned, the FWS student is no longer eligible for employment unless chosen to be hired as a Student Worker and paid through the hiring department’s budget.

To learn more or to apply, please visit the Federal Work Study section.

Use of Funds for Educational Expenses

Federal financial aid may only be used to pay for educational expenses. Educational expenses include tuition, fees, room and board and indirect expenses such as books, supplies, equipment, dependent child care expenses, transportation and rental or purchase of a personal computer.

Return of Title IV Funds

Title IV funds are awarded to students under the assumption that students will complete the periods for which the Federal Student Aid is awarded. When students receiving Title IV Federal Student Aid are considered withdrawn for Title IV purposes, reviews of eligibility are conducted to determine earned and unearned portions of Title IV aid.Students are considered withdrawn if they are administratively withdrawn, academically dismissed, judicially dismissed, or officially withdrawn.

For more information, go to visit the Return of Title IV Funds page.

Professional Judgement

- Dependency Override: cases of parental abuse, neglect, abandonment, or incarceration

- Income Loss/Changes: loss of employment; changes to household income (either taxed, untaxed, reoccurring, or one-time/lump sum income); divorce, separation, death of household income-earner, etc.

- Excessive Medical Expenses: excessive out of pocket medical expenses that exceed 11% of the tax-filer’s adjusted gross income (AGI)

- Increases in the student’s Cost of Attendance

The following are areas that generally are not considered:

- Circumstances when the information on the FAFSA has already resulted in an Expected Family Contribution (EFC) of zero

- Loss of overtime or bonus income

- Fluctuations in self-employment or business income

- Costs and fees associated with bankruptcies, foreclosures or debt collections

- Consumer debt such as credit cards, car payments, mortgages and other loans

- Payments on back taxes owed to the IRS or state department of revenue

- Lottery or gambling winnings or losses

Financial Literacy and Responsible Borrowing

Post University’s Financial Literacy and Repayment Advising is here to help all students with the repayment of their federal student loans. You can reach out to them while attending Post or anytime after you’ve completed your enrollment.

Making smart financial decisions when it comes to attending college will make for a less stressful process. To learn more about how Post University can make education more affordable and more valuable, visit Scholarships and Other Aid.

Get an early estimate on your total annual cost of attending Post

Use our Net Price Calculator