A college degree is one of the most valuable investments you can make

— one that can help you begin or advance your career and improve the future for you and your family. We understand paying for higher education may be a concern, and at Post University, you don’t have to put your dreams on hold because of cost.

Financing Your Education

Our team of financial aid advisors is here to help you find scholarships, federal aid, grants, and loans that may be available to you. With so many options to consider, you may qualify for more than you think.

Our team of financial aid advisors is here to help you find scholarships, federal aid, grants, and loans that may be available to you. With so many options to consider, you may qualify for more than you think.

Questions? Visit the FAQs page.

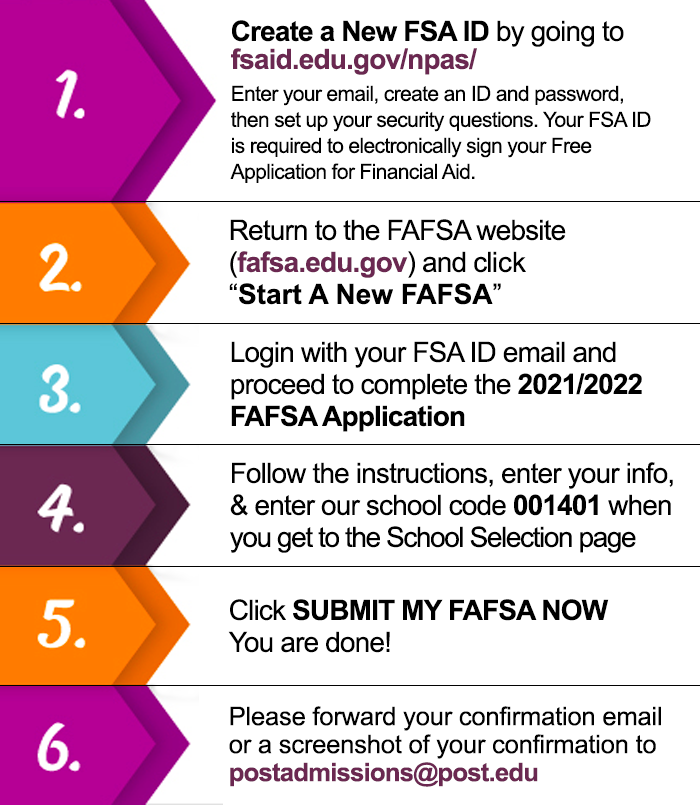

Complete your FAFSA with these easy steps

Financial Literacy and Responsible Borrowing

Post University’s Financial Literacy and Repayment Advising is here to help all students with the repayment of their federal student loans. You can reach out to them while attending Post or anytime after you’ve completed your enrollment.

Get an early estimate on your total annual cost of attending Post

Use our Net Price Calculator

Post's Financial Aid TV

Learn about financial aid through our library of short videos.

Office of Student Finance

– Financial Aid

800 Country Club Road

Waterbury, CT 06723-2540

Phone: 800.345.2562

On Campus: [email protected]

Online: [email protected]

– Financial Aid

800 Country Club Road

Waterbury, CT 06723-2540

Phone: 800.345.2562

On Campus: [email protected]

Online: [email protected]